Research Update: Looking at Consumer Expectations from Both Sides

// By Jane Weber Brubaker //

How is healthcare doing in terms of meeting customer expectations? Doctor.com surveyed 1,718 patients in 2018 to assess their needs and preferences regarding the customer experience of healthcare.

How is healthcare doing in terms of meeting customer expectations? Doctor.com surveyed 1,718 patients in 2018 to assess their needs and preferences regarding the customer experience of healthcare.

Kaufman Hall’s latest survey focuses on consumerism from the provider side, and offers an analysis of where 425 respondents from 200 healthcare organizations rate themselves on everything from improving customer experience to providing price transparency.

In this article, we’ll share highlights from both surveys, one confirming that consumers have high expectations of providers, the other showing positive movement but slow progress in meeting those expectations.

Consumer Perspectives: Customer Experience Trends in Healthcare 2018 (Doctor.com)

Provider Perspectives: 2018 State of Consumerism in Healthcare: Activity in Search of Strategy (Kaufman Hall)

To add some perspective, we grabbed a few snippets from Chris Bevolo’s conversation with Matt Gove, “Owning the Experience” from a recent episode of the Joe Public Book Club. Gove is chief consumer experience officer at Piedmont Healthcare and serves on the Editorial Advisory Board of eHealthcare Strategy & Trends.

“We don’t pay attention as closely as we should to what [consumers] want from us, and because of it, we risk losing control of our fate. And that’s a dangerous place to be,” Gove says. But he allows that some health organizations are living up to standards set by other industries, as we’ll see.

Consumer Perspectives from Doctor.com Survey

The Customer Experience Trends in Healthcare 2018 report confirms that customer experience, online and offline, is a major factor in selecting and and staying with a provider. Even when patients are referred to specialists by their own doctors, they go through a thorough vetting process, checking physician profiles and online reviews and star ratings, and this may cause them to change their minds and choose a different provider — one with better reviews and more stars.

And the survey revealed some surprising results about the 60+ age demographic: They are just as engaged as their younger counterparts in doing their due diligence before scheduling an appointment.

Here is a summary of the survey results:

What It Takes to Get a Five-Star Rating from Consumers

- 86 percent agree that if they receive quality care, good customer experience is the most important element to earning a five-star review.

- 70 percent consider good patient communication and engagement, such as reminders for follow-up or annual checkup, to be key to a five-star experience.

What Drives Customer Loyalty?

- 82 percent agree that when it comes to patient loyalty, quality customer service ranks as the most important factor, assuming quality care and treatment is received.

- 62 percent say good communication and continuous engagement influence their level of loyalty.

- 42 percent report that text and email appointment reminders also influence their loyalty and likelihood of returning to a provider multiple times.

Customer Perceptions of Online Presence, Reputation, and Reviews

- 60 percent chose one provider over another based on a positive reputation.

- 63 percent will choose one provider over another because of a strong online presence.

- 81 percent will read reviews about a referred provider occasionally, frequently, or always.

- 90 percent will frequently or always change their mind about a referral due to the provider’s poor or weak online reputation (a rating of less than three out of five stars).

- 53 percent will occasionally, frequently, or always change their mind about a provider with a rating of less than three stars.

- 74 percent of patients will choose one provider over another when searching for healthcare online because of negative reviews.

- Nearly 70 percent consider quality of reviews to be most important.

- 60 percent would not book with a provider with poor quality reviews.

Consumers Prefer Online Scheduling/Reminders

- 45 percent prefer to use digital methods to request an appointment.

- 42 percent will choose a healthcare provider because of the ability to use online scheduling.

- 71 percent prefer appointment reminders via digital means (email or text).

- 61 percent consider ease of appointment booking to be a major factor in giving a five-star rating.

Don’t Underestimate the 60+ Demographic

- 76 percent of respondents over 60 have made a healthcare-related search online in the past year [vs. 80 percent of overall respondents have used the internet to make a healthcare-related search in the past year].

- 56 percent say that a positive online reputation has impacted their decision to choose one healthcare provider over another.

- 80 percent will occasionally, frequently, or always read online reviews about a referred provider.

- 67 percent agree that availability of relevant and accurate information online has impacted their decision to seek one healthcare provider over another.

- 90 percent will occasionally, frequently, or always change their mind about seeing a referred healthcare provider with an online rating of less than three stars.

(See sidebar for additional information.)

The Flip Side: Provider Perspectives on Consumerism

Kaufman Hall’s 2018 Consumerism in Healthcare survey focuses on four key areas: access, consumer experience, pricing, and “The Foundation” (data-driven analytics and insights). Here, we’ll focus on the first two — access and consumer experience.

Overall, the survey finds that there has been positive movement year over year, but most health systems still lag behind.

The report categorizes respondents into four tiers:

- Tier 1 — Early adopters

- Tier 2 — Have taken a thoughtful approach

- Tier 3 — Reactive approach (70+% are at this level or lower)

- Tier 4 — Waiting for the leaders to act

Here’s how respondents rated themselves on access and customer experience:

| Access | Customer Experience | |

| Tier 1 | 12% | 7% |

| Tier 2 | 18% | 17% |

| Tier 3 | 60% | 66% |

| Tier 4 | 10% | 10% |

Access

If a patient can’t get an appointment, that’s an experience — a negative one. Although health systems are gaining ground — many are conducting pilots to test the viability of customer-centric choices such as same-day appointment scheduling, extended hours, and online scheduling — there are still large gaps that will need to be bridged to make these options widely available.

One respondent admitted, “A lot of work is being done right now — mostly in the planning and initial implementation stages. We have a long way to go.”

Availability of Flexible Scheduling Options

- About three-quarters of respondents report full implementation or pilot tests of same-day appointment scheduling and patient-provider messaging.

- About two-thirds report full implementation or pilot tests of extended hours.

- More than half report full implementation or pilot tests of online self-scheduling.

A low percentage of respondents reported availability of alternative care settings:

- 27 percent of respondents reported retail clinics as widely available.

- 14 percent reported video visits as widely available.

- 17 percent reported e-visits as widely available.

With companies like Amazon, CVS/Aetna, and WalMart encroaching on traditional healthcare, the warning bell has gone off.

Customer Experience

The survey collected data regarding several customer-oriented capabilities, with a surprisingly low percentage of organizations up to speed on a common pain point for patients — office wait times. Here are some of the highlights:

- Easy-to-find phone numbers — 64 percent fully implemented; 18 percent piloted

- Customer service training for staff — 50 percent fully implemented; 31 percent piloted

- Facility wayfinding support — 37 percent fully implemented; 30 percent piloted

- Reducing office wait times — 17 percent fully implemented; 44 percent piloting

- Customer-friendly billing statement — less than 50 percent implemented or piloted

The good news from this report is that there has been positive movement year over year. Overall, the survey indicates that there has been upward movement, with health systems migrating from a lower tier to a higher tier in some categories.

Matt Gove’s Top Picks

Matt Gove, chief consumer experience officer at Piedmont Healthcare

During Chris Bevolo’s interview with Matt Gove, a listener (me) asked if, given that healthcare in general is “so far behind,” any organizations have been able to catch up with — or rival — customer experience in other industries. Gove mentioned three:

- Kaiser Permanente in California: “They own the entire continuum from primary care to hospitals to home health,” Gove says. “Their use of asynchronous interactions with a physician or other clinician — the way that they use email and other electronic communication to manage their patients’ health and keep them out [of the hospital] feels as evolved as the best examples you see of that in the pharmacy industry where they’re helping you stay on top of your prescriptions.”

- Hospital for Special Surgery in New York is one of “the places that do really excellent high-end personalized service with individuals, who greet you at the door and provide you with a personalized experience.”

- Cancer Treatment Centers of America: “One thing that they do exceptionally well is give the patient the sense that they are the most important thing.”

In Kaiser’s case, as a highly integrated system that assumes risk for caring for its members, there is a strong incentive to reduce the cost of care by keeping patients well and out of the doctor’s office.

“I think the things that you’ll consistently see is the places that are delivering equal experiences to what you see in the real world are generally either places that have a very narrow specialty and/or they’re places that doing it makes money for them.”

Bing Users Drive Disproportionate Number of Appointments

Andrei Zimiles, co-founder and CEO of Doctor.com, shares an interesting insight not published in the company’s 2018 survey.

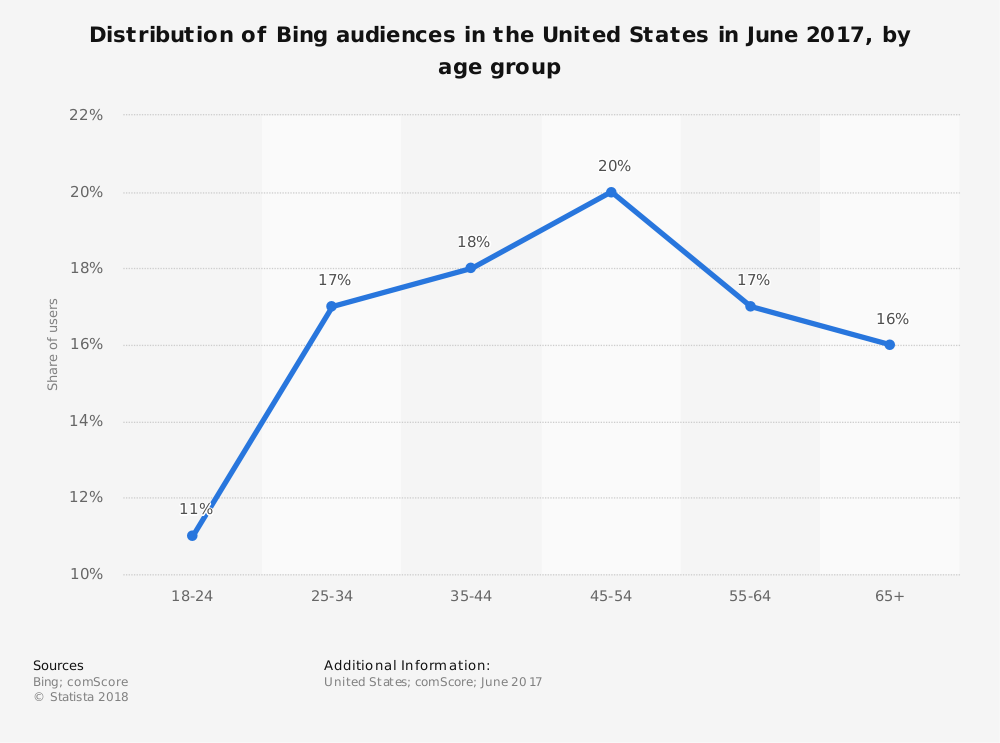

“Bing as a driver of appointments has punched above its weight from a market share/traffic point of view. It’s outperforming relative to other sources for the amount of traffic that it’s getting, and I think it’s because the audience that uses Bing is older, and more likely to be consuming healthcare services.”

Zimiles theorizes that Bing users buy Windows computers that come with Bing as the default search engine and they never change it. One-third of Bing users in the U.S. are age 55 to 65+, according to Statista.

Distribution of Bing Audiences in the U.S. in June 2017 by Age Group

Jane Weber Brubaker is executive editor of Plain-English Health Care, a division of Plain-English Media. She directs editorial content for eHealthcare Strategy & Trends and Strategic Health Care Marketing, and is past chair of the eHealthcare Leadership Awards. Email her at jane@plainenglishmedia.com.